The best peer-to-peer payment system

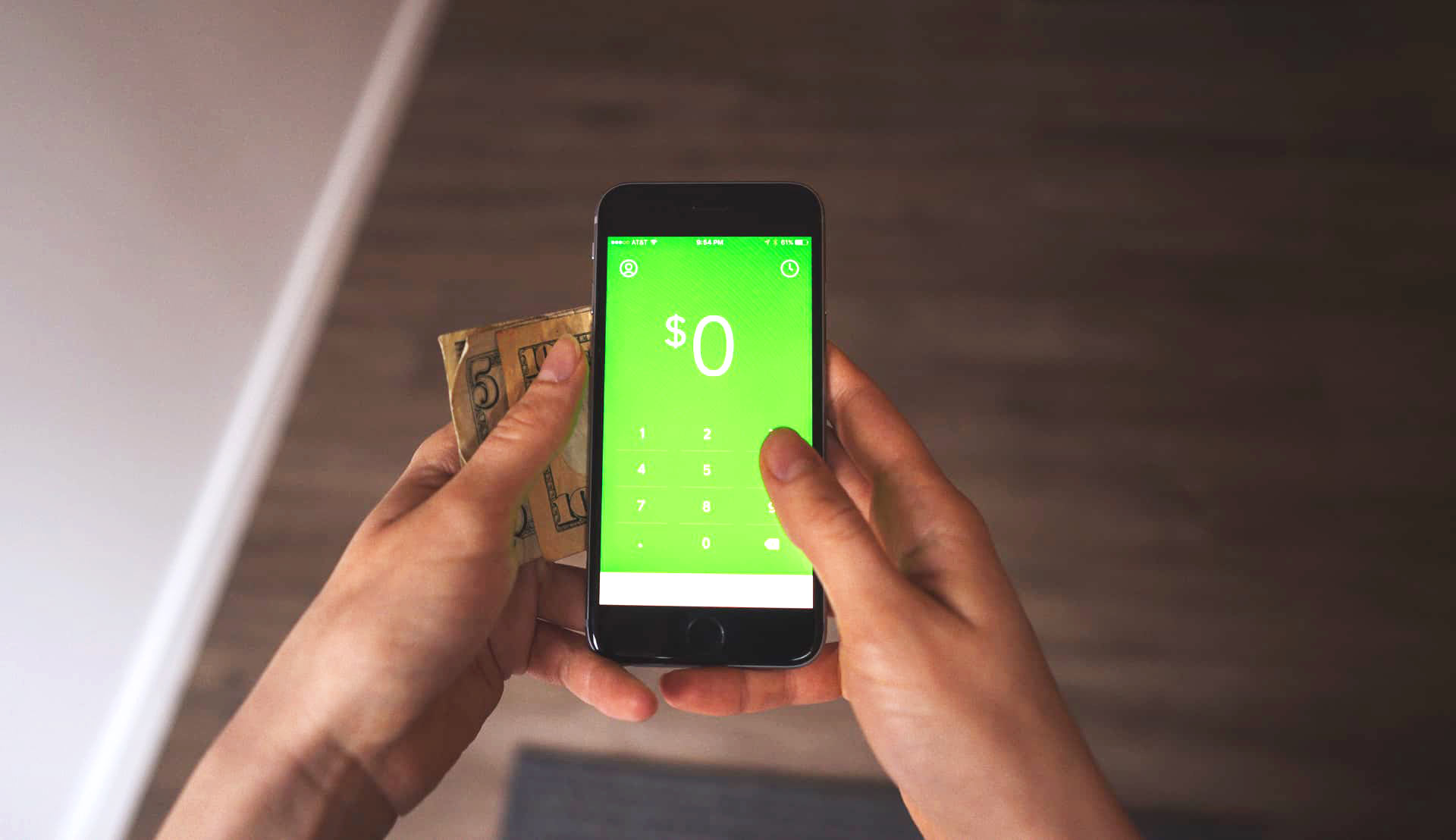

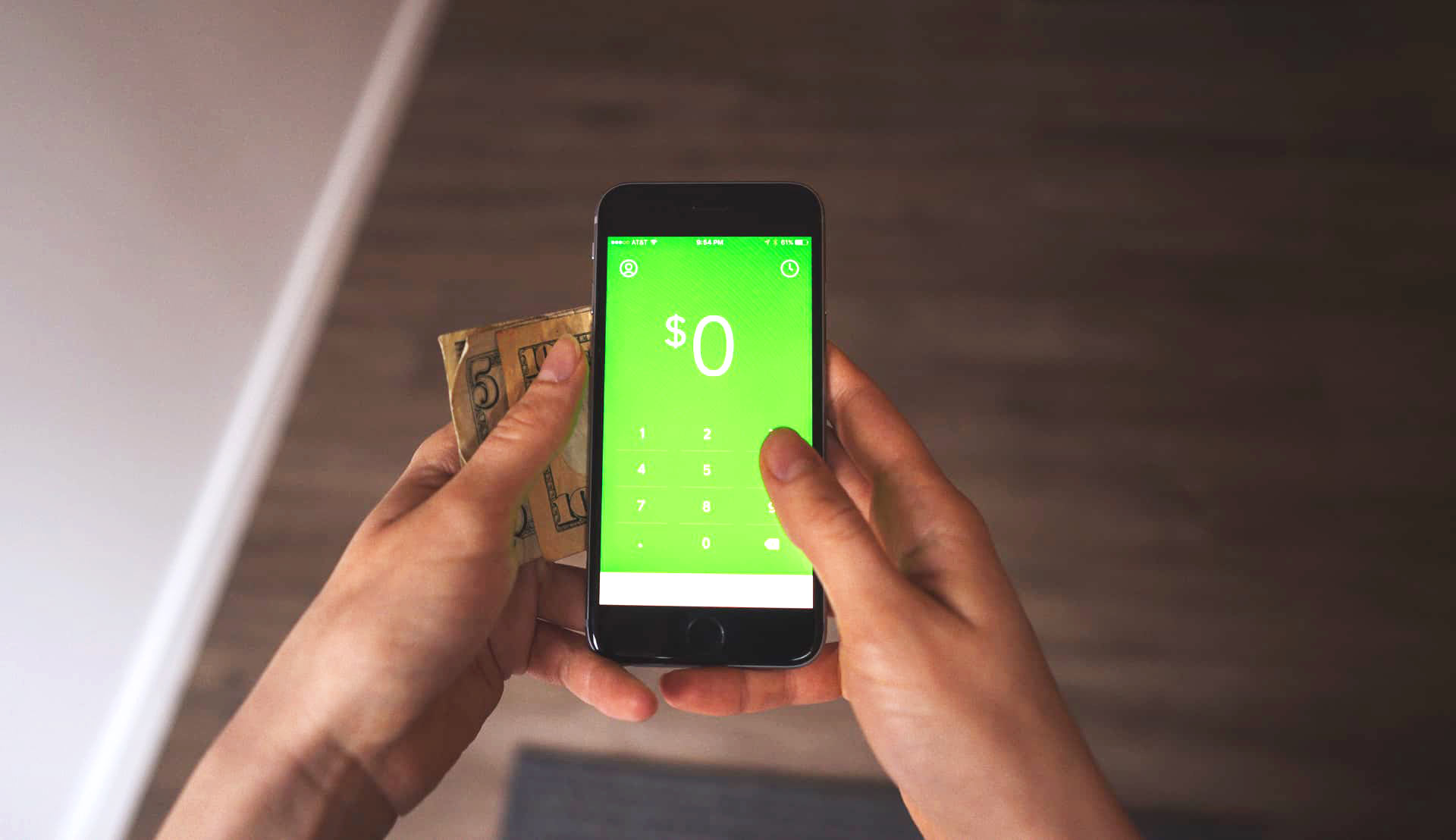

Square Cash

Has this ever happened to you: you’re out getting drinks or dinner with friends. The bill comes, and someone can’t pay their share with the cash in their wallet. Uh-oh. Separate checks? “Sorry,” says the waiter, “you had to ask for that up front.” What if your cash-strapped friend could send you their share with the phone in their pocket?

Over the last few months, we’ve looked at several of the top peer-to-peer payment apps to find which is the fastest and safest way to send money from person to person.

Square Cash is our favorite peer-to-peer payment app for its simple, uncluttered interface, fast setup, and solid security features.

Use Case

There’s been a small explosion of apps that promise to make sending money easier and take the strain off having to carry cash. Of course, to make all this work, your friends need to not only have the app, but link it with their bank account or debit card. And, of course, the experience has to be easier than just finding the nearest ATM and making change.

Most peer-to-peer payment apps work the same way. They link to your bank account, debit card, or credit card. When you send a payment, they withdraw money and hold on to it until your friend claims the transaction. That money then moves into your friend’s account. Easy-peasy, right?

Well, not so much. If your friend wants that money for the cab ride home, they’ll have to transfer it to a bank account. That’s where things take longer since your transaction has to move through the bowels of the American banking system — and that’s if you’re using your bank account and debit card. Using a credit card means you’re also going to get a chunk of change eaten by transaction fees.

It’s also worth noting that most, if not all, of these apps only work in the United States. There are other apps that work with other banking services in other countries, but I was unable to test with foreign banks. If you’re looking to send money internationally, PayPal is probably your best bet.

Still, sometimes the convenience of being able to send money as fast as a text message wins out. If you and your friends can agree on a solution, it can be quite handy.

Scope

When you’re picking an app for peer-to-peer payments, there’s a lot to keep in mind.

- Ease of Use Is it easy to send and request money without a lot of taps? (Especially if we are talking about beer money. You don’t want to send 100 bucks when you meant to send 10.) Is it also easy to add your bank account and credit card? If you’re spending an hour fighting to get your account set up, it might just be easier to find an ATM.

- Security This is a huge one. This is your money we’re talking about. The last thing you need is someone grabbing your phone and sending your most recent paycheck to some stranger.

- Ubiquity If you’re trying to share money between friends, it helps if they’re already on the same app. We all have enough stuff we’re signed up for.

- Nuts and bolts How many ways can you transfer money, and how many ways can you get it out? Some apps aren’t just transfer systems, they’re Internet banks with checking accounts and all that entails. Ideally, you want something designed just to move money, not manage it.

Our pick

Square Cash is the easiest and fastest way to shoot money from person to person with a smartphone. With a simple, uncluttered UI, fast sign up, and TouchID security on supported phones, it’s a secure way to share money between friends.

Sign Up

The sign up process is easy — just provide your phone number. Square will send you a confirmation code, and you’re in. You can then scan your credit or debit card with your camera to link them to your account. Square does charge a 3% processing fee when using a credit card, but debit card transactions are free.

Sending and Receiving

Once you’re set up, all you need to do is tap in the amount of money, hit “Request” or “Pay”, choose a contact, then either hit a PIN or use TouchID to confirm. It’s that simple. If your friend isn’t signed up for Square Cash, they’ll be able to get up and running quickly thanks to the easy process outlined above. Square Cash also lets you use Bluetooth to find people nearby to send money to. This can save a bit of time when you know your friends have Square Cash installed on their phones.

Getting money out of Square Cash is also simple. You can tap the profile icon in the top right corner and transfer money right back to your debit or credit card. Square Cash also allows you to set up a web-based “Cashtag” (like $sanspoint — hint, hint), so you can send a payment link in text messages or emails when someone wants to shoot you a few bucks.

The only complaint I have with Square Cash is the same as most peer-to-peer payment apps. Your money is held by Square until they can transfer it back to your bank account, which can take at least a day, sometimes longer, depending on your bank.

Runners Up

PayPal

PayPal has one advantage over Square Cash: ubiquity. PayPal has nearly 180 million registered users, so if your friends are wary about signing up for another service that can access their bank accounts, odds are they already have a PayPal account.

PayPal’s app was recently updated with TouchID and support for the iPhone 6 and 6+ screen size. Sending and requesting money is fast, too, but linking cards and bank accounts is a chore. Fortunately, you only have to do that once, and you’ve probably got something set up there already. PayPal, like Square Cash, also has a new web service called PayPal.me where you can create a link to send for payment requests.

Venmo

Venmo is probably the most famous of all the peer-to-peer payment apps out there. It’s easy enough to sign up, and unlike most of the apps on this list, supports 1Password. That’s where the fun part ends. Adding cards is a hassle, and adding a bank account requires tracking down your routing and account numbers.

The biggest issue I have with Venmo, however, is that your transactions are displayed to the public by default. The first view once you’re logged into Venmo is a list of transactions from people all over the world. Making your transactions private is a chore that requires going into settings and changing several options. And, if that’s not enough, Venmo has been implicated in multiple scams and card breaches.

Google Wallet

Google’s also gotten into the payment game with Google Wallet. Like PayPal, Google’s advantage is that you probably already have an account. Just log in, add your card, and you’re ready to go. Google Wallet also has a unique feature where you can split a transaction to send money to multiple people at once. Unfortunately, security is where Google Wallet falls short: your only option is a 4-digit PIN. TouchID is completely absent.

Dwolla

Dwolla is a very popular app, but I can’t figure out why. Setup in the iOS app is a series of web views with no 1Password support, and it asks for more personal information than any other service I tried for this review. It doesn’t support linking cards — only bank accounts with routing and account numbers. The difficult setup process alone makes me unwilling to recommend Dwolla.

(Another blow against Dwolla is that it requires a U.S. bank account. If you aren’t in America, this isn’t a tool you can use.)

ChimpChange

ChimpChange purports to be a peer-to-peer payment app, but it’s actually an app for an online checking account. Signing up creates a new account and sends you a debit card. This is useful if you’re not happy with your current bank and want a service made for sending money around, but not so useful if you’re happy with your bank and feel like you carry enough cards.

Popmoney

Popmoney’s app is nice enough, and the TouchID support is appreciated. Sadly, the interface is clunky, and after several tries, I wasn’t able to send any money to anyone.

Conclusion

Square Cash and PayPal are our top choices, but peer-to-peer payment apps are still a bit of a hassle overall. If you and your friends are willing to find an app and stick with it for sharing money, it can be very useful. Because of the quirks of the American banking system, however, money can take its time getting back to your bank account. It’s no substitute for cold, hard cash when available, but the best of these payment apps can do in a pinch.